About Us

A saga of vision and enterprise

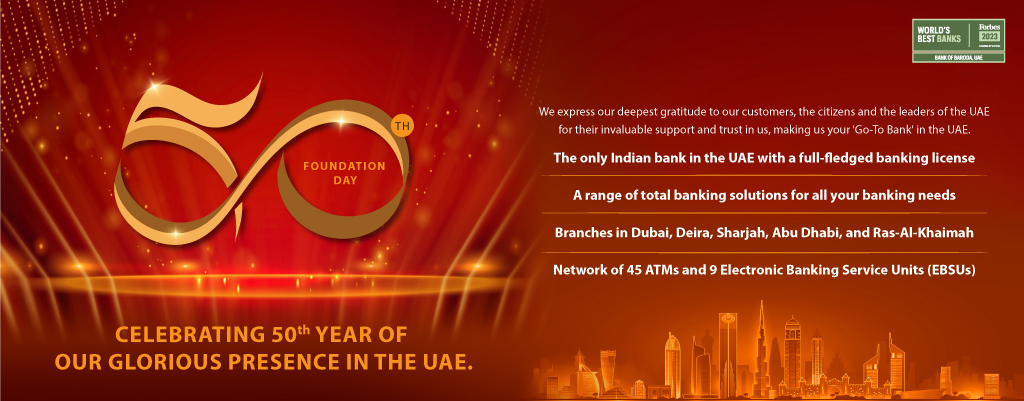

It has been a long and eventful journey of more than a century, Bank of Baroda in India The parent Bank has International presence in 94 overseas offices spanning 17 countries. Starting in 1908 from a small building in Baroda to its new hi-rise and hi-tech Baroda Corporate Centre in Mumbai, is a saga of vision, enterprise, financial prudence and corporate governance. It is a story scripted in corporate wisdom and social pride. It is a story crafted in private capital, princely patronage and state ownership. It is a story of ordinary bankers and their extraordinary contribution in the ascent of Bank of Baroda to the formidable heights of corporate glory.

Read MoreProducts

- Personal Banking

- Business Banking

Personal Banking

- Bank Account

- Loans

Business Banking

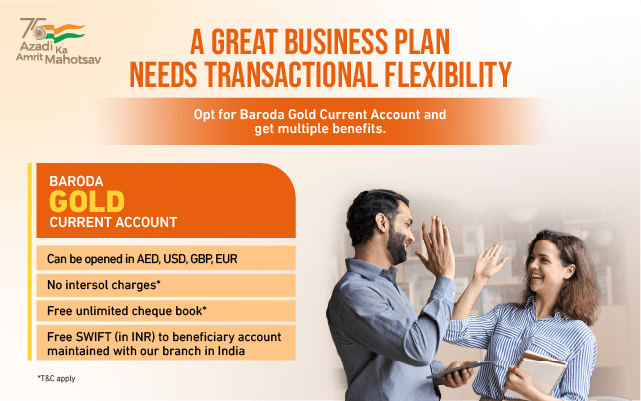

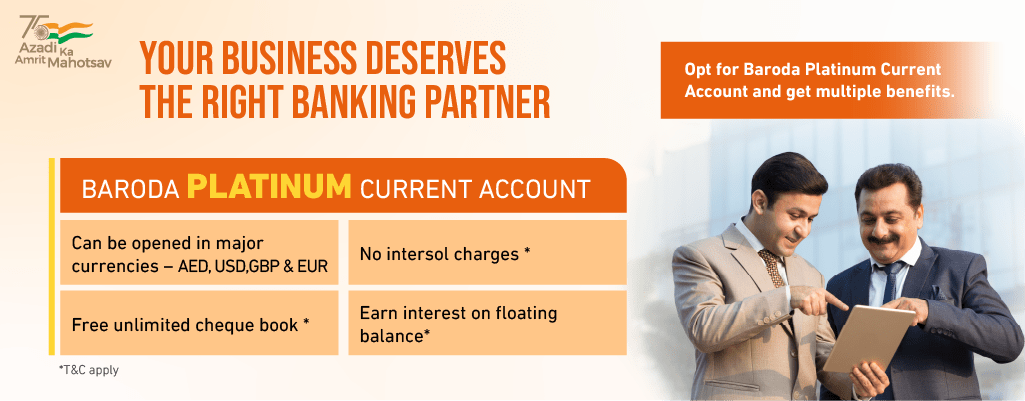

- Business Bank Account

- Loans

Exchange Rates View All

-

INR

0.04310 Buying

0.04435 Selling

-

EUR

3.8701 Buying

3.9997 Selling

-

CHF

4.0993 Buying

4.2103 Selling

-

JPY

0.02418 Buying

0.02471 Selling

-

USD

3.6550 Buying

3.6850 Selling

-

KWD

11.8829 Buying

11.9518 Selling

-

GBP

4.5518 Buying

4.7071 Selling

-

QAR

0.9933 Buying

1.0185 Selling

-

SAR

0.9661 Buying

0.9903 Selling

-

SGD

2.6762 Buying

2.7651 Selling

Disclaimer: Rate shown are indicative for the day and subject to change without prior notice. Last Updated: February 14, 2024